- November 19, 2021

- Comments: 0

- Posted by: Sue Smith

Contents:

Dr. Elder is the originator of Traders’ Camps week-long classes for traders, as well as the Spike group for traders. Dr. Elder is a top-rated speaker at conferences worldwide and at corporate retreats. In addition to a wealth of knowledge he brings a great personal warmth and teaching ability. Whether your meeting is designed for billion-dollars money managers or retail brokerage clients, Dr. Elder will engage and energize your group. “You can be free. You can live and work anywhere in the world. You can be independent from routine and not answer to anybody. This is the life of a successful trader.” Gaetz invests a significant amount of his net worth on real estate.

After emigrating to the United States, Elder worked as a psychiatrist in New York City and then taught at Columbia University. Elder’s background as a psychiatrist helped him gain valuable insight into the psychology of trading. As cyclical as the market is, it is not easy to predict its movements (we wouldn’t have so many traders losing money otherwise).

Shop Elder.com

Again, other methods for determining the weekly trend can be used instead of using the MACD zero crossover on the daily chart. We will use that technique in this article to simplify the charts and discussion. Spikers – a group of professional and semi-pro traders – compete for prizes each week. Their trades are open to all Members, allowing you to follow their reasoning, ask them questions, and track their picks and orders in real-time. You are also welcome to earn credits by submitting your own picks if you like. Elder.com is always at the cutting edge of modern markets, helping clients become better, more confident traders.

If we used a factor of 4, the next down in line time frame is the 1-hour chart. For example, if your first screen is the daily chart and we downgrade our time frame by a factor of 6, the next time frame would be the 4-hour chart. This in return will help us spot good times to execute your trades.

Join Our Email List:Your privacy is guaranteed.

Alexander Elder’s “The New Trading for a Living Book” emphasized that the Triple Screen system can’t be used to provide concise buy and sell signals. Alexander Elder trading strategy works as a methodology of verification of the trend from a one-time frame to the next. He is the author of a dozen books, including Come into My Trading Room (Barron’s 2002 Book of the Year) and Trading for a Living, considered modern classics among traders. Alexander Elder’s net worth is between $100 and $1 million. At sixteen, he entered medical school and then jumped ship to land in Africa. He eventually obtained political asylum in the United States, where he worked as a psychiatrist and taught at Columbia University.

Dr Alexander Elder is seen to be a legendary trader amongst many in the global trading community – this is the general consensus. Especially, it is perceived that his best-selling books and articles tend to very much help the beginner trader. Investments involve risks and are not suitable for all investors. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

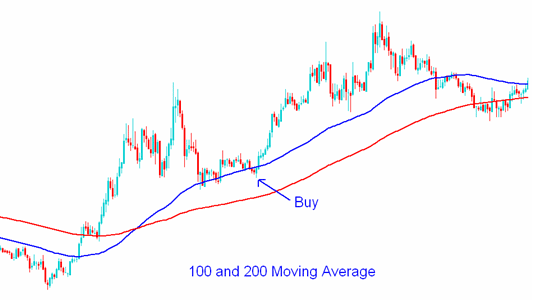

He advocated using a trend following indicator like the moving average, Bollinger Bands, or the Ichimoku Kinko Hyo. You should then combine this indicator with an oscillator like Stochastic, Relative Strength Index , and Relative Vigor Index. It is widely known that no single indicator can provide reliable signals on its own. Therefore, he recommended that traders should focus on using a few technical indicators to make your decision. The 1 January 1951-born Businessperson expert is arguably the world’s most influential Alexander Elder is expert, with a wide-ranging social media outreach.

To determine a larger trend use a long-term time frame that is well adjusted to your preferred one. There is bull dominance in the market when the EMA13 is rising and when the MACD histogram is going up. We marked these situations using green rectangles on the exemplary chart below.

He won two tournaments and won in a playoff the Greater Milwaukee Open. He represented the United States at The Ryder Cup in 1979. His success as an American Businessperson is what determines his net worth. His estimated age and height will be 70 years old by 2021. This is a relatively young age, but his income from his various businesses has made it possible for him to make his net worth as high as it is today. The first thing to know about Dr. Alexander Elder’s net worth is that he has a large amount of social media presence.

Traders using daily charts for an intermediate timeframe can simply move to weekly charts for a long-term timeframe. The choice is not as clear-cut for smaller or longer timeframes. Traders using 10-minute charts to chart their “intermediate” timeframe can use 60-minute charts for their “long-term” timeframe. Investors using weekly charts can base the bigger picture on monthly charts. Once the trading timeframe is decided, chartists can then use the longer timeframe to identify the bigger trend. Chart 2 shows daily bars with the Elder Impulse System and the 65-day exponential moving average, which is five times the 13-day EMA.

Trading With Dr. Elder

The Elder Force Index indicator, generally speaking, uses both volume and price to determine the right move in trading any financial instrument. You can use various timeframes in this strategy to find it applicable, however the bigger/longer trend should always be kept in mind. A formula recommended by Elder, is to choose your trading timeframe and then multiply it by five to determine the long-term timeframe for the overall.

Bear Alexander Enters Transfer Portal – Sports Illustrated

Bear Alexander Enters Transfer Portal.

Posted: Sat, 15 Apr 2023 17:52:29 GMT [source]

You can expect personal care, serious answers to your questions, and unhurried attention. We want you to become one of many traders who have been our clients for over 30 years. Again, much like Dr Alexander Elder, himself, this is very logical.

Continue reading to learn more about this legendary merchant. This fascinating biography will teach you about the history of the British-Canadian fur trade. You’ll learn about Alexander Elder’s accomplishments in the fur trade and his impact on the lives of the people of the area. Alexander was born in Saint Petersburg in Russia but he grew up in Denmark with his two brothers.

Here, you should take time to create a strategy which will help you make the best decision. This involves creating a good strategy which combines technical and fundamental analysis. Most traders believe that trading is like gambling (it isn’t!) where they can make money by making simple bets. This is a step that all traders go through, you therefore decide to try your hand in the financial market. Dr. Elder is the originator of Traders’ Camps week-long classes for traders, as well as the Spike group for traders.

The New Sell and Sell Short

Expert market commentary delivered right to your inbox, for free. Your monthly dues entitle you to receive all Spike materials, including all picks and updates. Spike is unique in paying you for doing homework – whenever you submit a tradable pick you earn Participation credits. If your pick outperforms the third best Spiker pick of the week, you’ll receive a much larger Performance bonus.

A money management plan will help you make informed decision on how to use the money you make and the amount of money to invest. The idea is to have a strategy that states that IF A happens, THEN B will happen. This will help you make sound trading decisions on every trade you start. You should create a system and backtest it to ensure that you are successful. In this step, you should learn how to define your method of analysis.

Continue https://forex-world.net/ing to learn more about this well-known trader. The Elder Impulse System can be used across different timeframes, but trading should be in harmony with the bigger trend. Elder recommends setting your trading timeframe and then calling it intermediate; then, multiply this intermediate timeframe by five to get your long-term timeframe.

Well, that is something only you can answer based on your own opinion and understanding of wealth. As with many things in life, perceptions amongst individuals are always varied based on their own standards and experiences. You should never trade money that you cannot afford to lose.

But did you know that he has a successful business career, too? Another triple screen model that he promoted was on multi-timeframe analysis. This is a type of analysis where you analyze an asset across multiple timeframes.

Hunting and Fishing Estate Asks $14.974 Million, Becoming One of … – The Wall Street Journal

Hunting and Fishing Estate Asks $14.974 Million, Becoming One of ….

Posted: Wed, 12 Apr 2023 19:00:00 GMT [source]

For example, if your preferred time frame is the daily chart, you first start by looking at higher time frames like the weekly chart. This is the chart where you’re going to apply the trend-following indicators to establish your bias. Dr. Alexander Elder is a renowned day trader who has written several books on day trading. Most of his books are now top-sellers that have generated millions of dollars in revenue.

A blue price bar indicates mixed technical signals, with neither buying nor selling pressure predominating. If you’re reading this, you are most likely well-informed of how big the world of CFD trading and general trading has become. Perhaps even more so, you are finding yourself becoming more immersed into the trading and financial world; the trend of the retail trader ha… What advantages and disadvantages come from trading Forex? The world of trading, and the choice to venture into a career as a trader is a direction which requires you to never stop learning and testing your strategies. As with many things in life, experience and time is invaluable.

Social worker and community volunteer awarded annual Dr … – Williamsport Sun-Gazette

Social worker and community volunteer awarded annual Dr ….

Posted: Thu, 13 Apr 2023 13:46:52 GMT [source]

Given that, the first three green arrows on the Alexander elder show valid daily buy signals (i.e. new clusters of green daily bars). Note, however, that the first couple of red bars on the chart are NOT valid sell signals in this case because the weekly trend is still positive . The red arrow shows the first valid sell signal that happens after the weekly trend turns down. Similarly, the weekly trend must turn positive again before valid buy signals are given .

To the memory of Lou Taylor— a wise man, a savvy trader, and a true friend. The technical storage or access that is used exclusively for anonymous statistical purposes. To check for alternative titles or spellings.You need to log in or create an account to create this page.

- The Elder trading system came in response to a well-known problem that certain technical indicators only work in a certain market environment.

- We recommend that you seek advice from an independent financial advisor.

- Dr Alexander Elder is seen to be a legendary trader amongst many in the global trading community – this is the general consensus.

- He wrote The New Trading For a Living, a bestseller that provides practical strategies and tips to help investors succeed.

The last part of the Alexander Elder trading strategy is where all the fun begins. Now, let’s get into more details and learn how Dr. Alexander Elder has taught the three-screen method n the New Trading for a Living by Alexander Elder book. The entire audiobook is available here and takes about three hours to finish. Below, we will break down the most important things to know about Dr. Alexander Elder’s important work. As you can probably tell, the Alex Elder trading rules involve the use of multi-timeframe analysis.